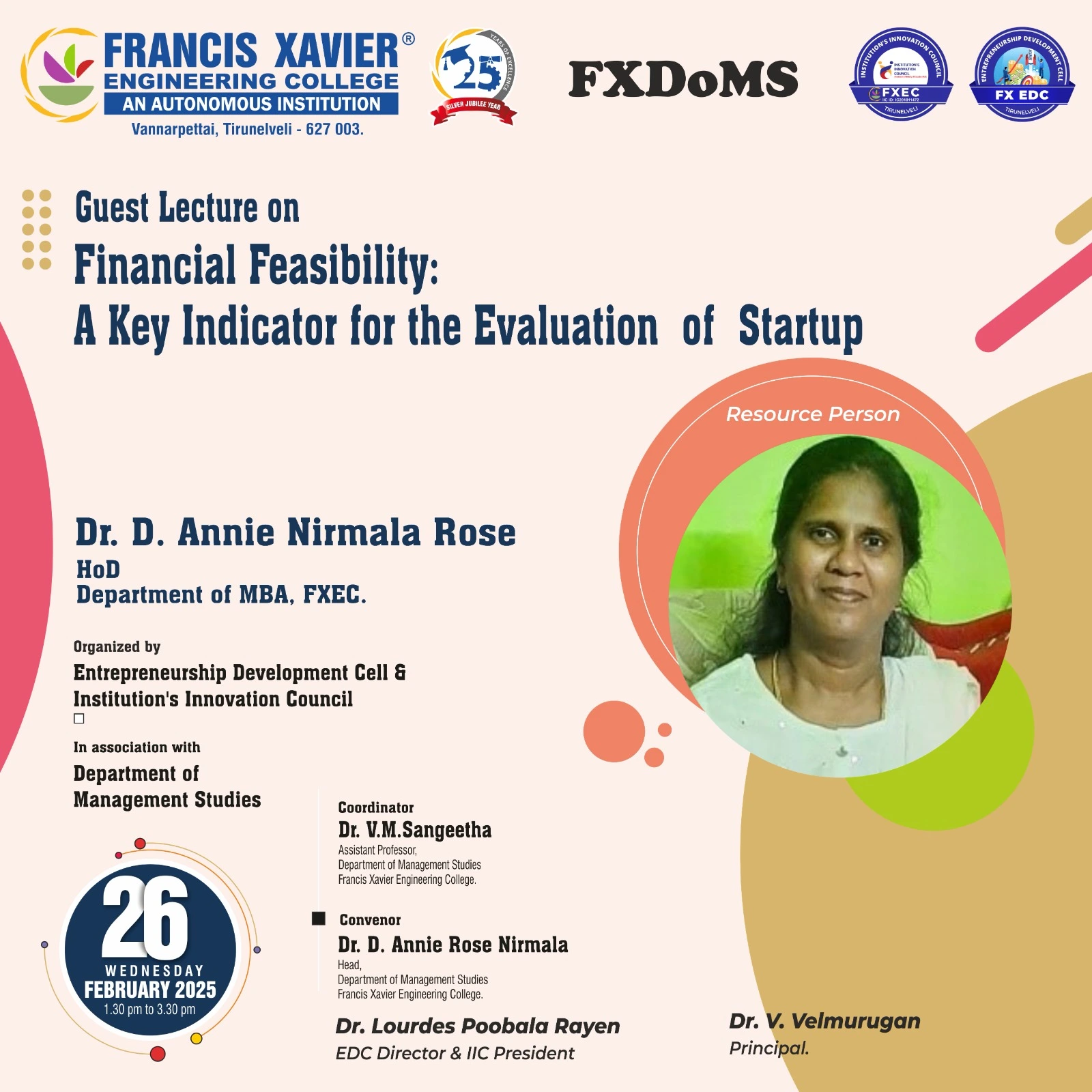

On 26.02.2025 session on " Financial Feasibility: A Key Indicator for the Evaluation of Startup" was organized by the Entrepreneurship Development Cell of Management Studies department and IIC through offline mode. The session was handled by Dr.D.Annie Rose Nirmala,HoD/MBA Francis Xavier Engineering College from 10.00 AM- 12.00 PM on 26.02.2024. 42 students and one faculty participated in the program.

The resource person began the session by emphasizing that finance plays a crucial role in determining whether a business can survive, grow, and sustain itself in a competitive market. Many startups fail due to inadequate financial planning, making the assessment of financial feasibility a critical step in the business planning process. She highlighted that one of the primary considerations for any startup is the availability of sufficient capital to cover both initial and operational costs. Initial capital requirements include expenses for infrastructure, equipment, and legal formalities, while operational costs cover day-to-day expenses such as salaries, utilities, and marketing.

In addition to financial planning, analyzing market demand and understanding the competition are essential to gauge the viability of a startup. Economic conditions, including inflation rates and government policies, can significantly influence business operations and profitability. She also discussed the major types of funding options available for startups, outlining various sources of capital that entrepreneurs can consider like bootstrapping, Angel Investment, Venture Capital funding, Crowd Funding and Bank Loans. The resource person emphasized that identifying financial risks is crucial for ensuring the long-term sustainability of a startup. Operational and market-related risks, such as fluctuating demand, pricing pressures, and supply chain disruptions, must be carefully evaluated. Implementing risk mitigation strategies, such as cost control measures, financial reserves, and diversified revenue streams, can help safeguard businesses against uncertainties.

She further explained that a financial feasibility study involves analyzing costs, revenue potential, and funding options to assess the overall profitability and sustainability of a startup. Entrepreneurs must evaluate the expected Return on Investment (ROI) and determine whether the business model is financially viable. A thorough feasibility study helps in making strategic decisions, ensuring that the startup is well-prepared for financial challenges.